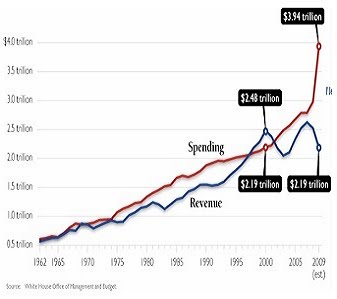

I've been waiting for someone to step up to the plate and show me the mathematices on how the Treasury will fund its spending needs if the Fed stops printing more money after June 30. Jim Rickards is all over the blogosphere like famine in Africa explaining that the Fed can fund Treasury auctions without increasing its balance sheet. I would like him to show me the math on that. HERE is the math on my view, as clearly and articularly elucidated by zerohedge:

So putting it all together: assuming no QE3, and just continued rolling and transforming MBS in UST purchases, means that the Fed will have about $12 billion in average UST purchases per month from maturity extension, and about $20 billion from MBS prepays. This is at best one quarter of the amount the Fed monetizes per month currently and is largely inadequate to continue funding the US deficit.Here's the link to the article with links to the reference sites so you can check their math if you so desire: TO QE3 or NOT TO QE3

So if the Fed does not step up to the plate and print more money to fund Obama's Government, then who will? The Japanese? LOL. I think they have their hands full right now and probably need any excess liquidity to fund their own current problems. Capisci? How about the Chinese? Read this article which had almost no real media exposure:

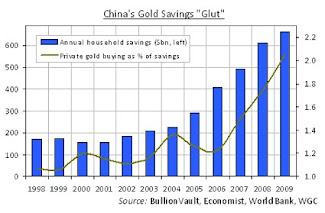

A former adviser to China's central bank said on Monday that China should have retreated from the U.S. government-bond market and instead allowed the yuan to appreciate more freely, warning that U.S. sovereign debt was akin to a giant Ponzi schemeHere's the link for that news item, which actually came out yesterday: LINK I think it's safe to say that the Chinese probably won't increase their Treasury holdings, have been systematically hedging them out with gold and silver and the real risk is that they start dumping them, like Pimpco's Bill Gross. Oh ya, the world's largest bond investment fund is not a likely candidate to fund Obama since he's now net short the Treasury market.

And if you still want to suspend your disbelief and buy into the garbage coming from many Fed officials plus Rickards, please take the time to read this extraordinarily well-written analysis from Alisdair Macloed:

One of the stark alternatives is to end quantitative easing and permit far higher interest rates, plunging the Obama administration into bankruptcy and the US economy into deep economic cleansing. The other is more ZIRP plus QE3 resulting in accelerating stagflation, made worse by a rapidly depreciating dollar. LINKHe argues that the Fed will pay lip service to being inflation-vigilant by delivering a gratuitous 1/4 point hike in the Fed funds rate, but will be forced to continue printing money or else Obama's spending dreams die and the Govt goes insolvent. I have made that same argument, in terms of the Fed justifying more printing by patronizing the M2 critics with a tiny, useless hike in interest rates.

So there you have it. I suggest everyone ignore the flatulence coming from NYC and DC and start looking at their own finances and move some assets into gold and silver. Silver supplies are starting to dry up and the mining supply is not coming close to covering the demand globally. And if you really want to be irritated, check out the nice gift that Geithner, Hank Paulson (and de facto Bush and Obama) gave to their good friends on Wall Street using your money: The Real Housewives Of Wall Street

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

Run this linked article through Google Translate. The author in China of the wildly popular books, Currency Wars, essentially the Chinese version of the Creature From Jekyl Island is out with his predictions for silver. $50 this year on a target to $200. As one of the most respected financial writers in China, one can fill in the blanks of the net effects of it. Witness today, where JPM must have blown a few hundred million trying to knock silver well below $40 only to be met with epic buying. Guess who?

ReplyDeletehttp://biz.cn.yahoo.com/ypen/20110411/301158.html

Awesome comment JK

ReplyDeleteI believe you are correct. My precious metal position is so large at this point, however, that this summer will be exciting to say the least.

ReplyDeleteYou know what makes no sense? That there is only one guy, Taibbi, writing stories like this in the mainstream media. He really knocked it out of the park again.

ReplyDeleteMaybe the housewives of Wall Street have been buying gold and silver with their bonuses, LMAO.

ReplyDeleteDave,

ReplyDeleteMarkets do not behave in a rational way. There have been enough signals from several Fed officials that there will at the very least, be a pause in QE2 before they start monetizing again.

Your question is a good one - where will the money for funding treasuries come from? I think they'll come from the capital that will flee equities, commodities, precious metals to US treasury bonds.

I don't think that support will last in a sustainable way but at the very least, the PTB would want to see what happens if they take a breather..don't you think?

MacLoed also says in his article the Fed should raise interest rates by 1/4 point.But he then goes on to say this about then increase This would be designed to take the steam out of gold and to help stabilise the dollar, thereby reducing inflation concerns. At the same time, it will make little difference to both banking and government funding costs.

ReplyDeleteso unles I'm reading it wrong this would not be good for gold or silver

Anybody who has a passing knowledge of arithmetic knows that a Ponzi scheme can't reach a stable plateau because the interest on debt is ever accruing. A Ponzi scheme requires capitalisation of interest and this means debt has to increase or deflation ensues. Stabilising the debt by rolling over the principal slows the rate of growth of the Ponzi. But if the interest is paid out on a current basis deflation defacto takes place.

ReplyDeleteSo if the Fed does not step up to the plate and print more money to fund Obama's Government, then who will? The Japanese? LOL. I think they have their hands full right now and probably need any excess liquidity to fund their own current problems. Capisci? How about the Chinese?

ReplyDeleteI am becoming convinced that the answer to this question is: The IMF, complete with forced tax hikes and austerity measures. I'm guessing in 2013.

Democrats get their tax hikes.

Republicans get their spending cuts.

Americans get raped.